Real estate know-how in development

and portfolio administration

Our company

Short profile

VIB Vermögen AG operates a “develop-or-buy-and-hold” strategy. We develop properties for our own portfolio and acquire existing properties in order to generate rental income. VIB Vermögen AG’s real estate portfolio includes logistics properties, industrial properties, shopping and retail centers as well as commercial and service centers.

Free rental space

Our current offers

Discover attractive properties and spaces with a variety of possible uses.

Investor Relations

News

- All

- Ad-hoc News

- Corporate News

Compact objects

The Interpark Ingolstadt

Six objects on strong location in the Interpark near Ingolstadt.

Rentable area:

1.2 Mio. sqm

Annualised net rent:

82.8 Mio. €

Rental rate:

98.3 %

Attractive Mix

The chart shows the share of sectors in net rental income of our property portfolio. Learn more about the attractive mix from the sectors of logistics/light industrial, retail and office as a basis for broad risk diversification.

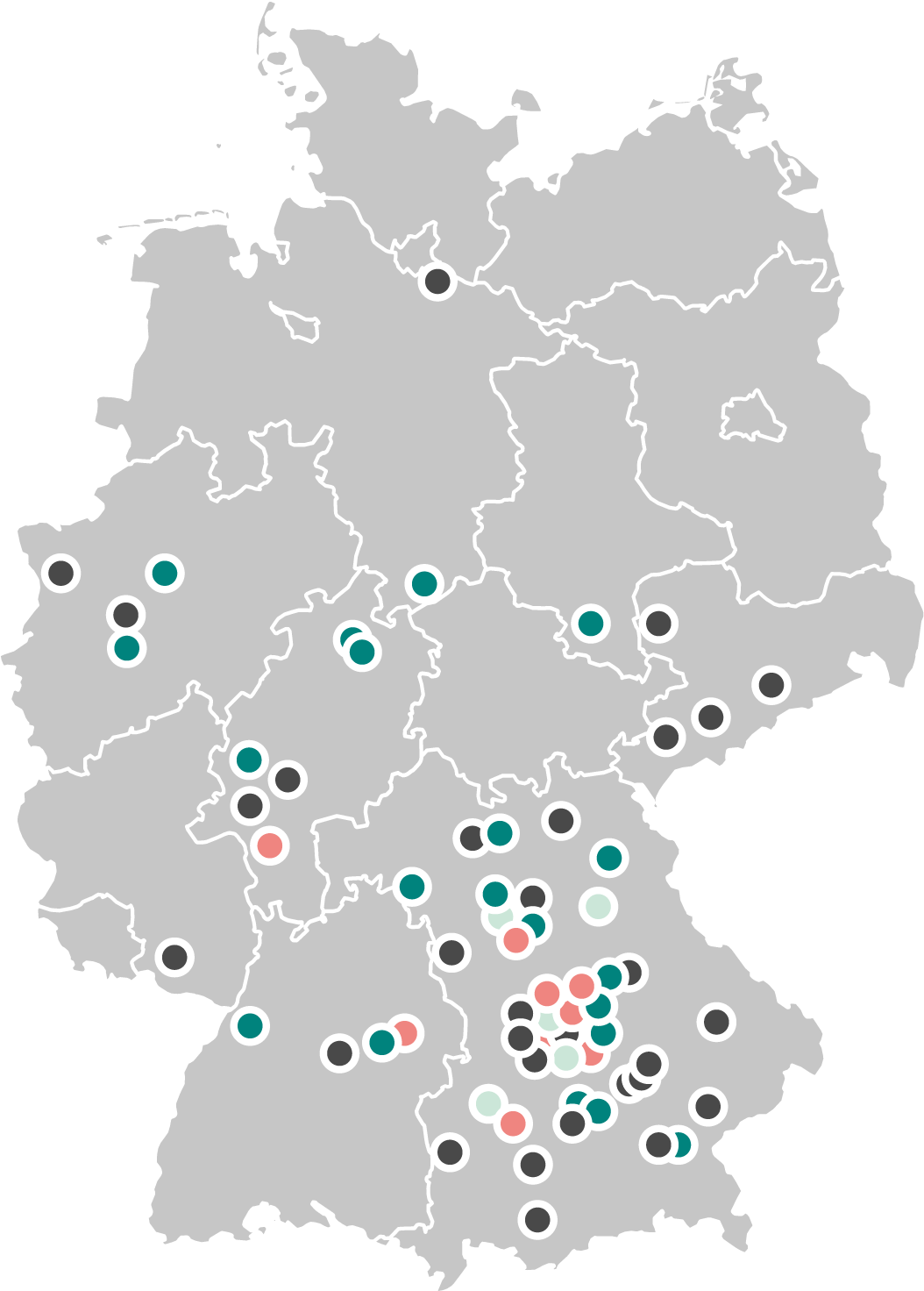

Solid South

We have been investing in commercial and industrial properties located in South Germany where growth is strong – with a few attractive exceptions – for almost 30 years. Learn more about the high quality of our real estate portfolio and the balanced branch structure of our renters.